While the entire DeFi market is still struggling to achieve 5% yields , a structured arbitrage opportunity is emerging through equity perpetual contracts . Retail investors' demand for leverage in high-beta (high-volatility) assets like $NVDA (Nvidia) has created a significant funding premium, which institutional funds are currently finding difficult to offset.

BitMEX's invention of perpetual contracts pioneered a new model for making money in the cryptocurrency world. Now, this mechanism is engulfing the traditional stock market.

We believe that the current perpetual stock market in the US is significantly inefficient, attributable to high retail speculative sentiment, the use of oracles during market closures, and friction between TradeFi and DeFi.

Today's article will guide you step-by-step on how to leverage these factors to build a Delta-Neutral profit strategy. Let's get straight to the point.

From XBTUSD to US Stock Market Perpetuality: What exactly is this thing?

In 2016, BitMEX launched the XBTUSD perpetual contract, creating the first tool that allowed traders to speculate on prices with leverage without a settlement date. It became the most traded product in cryptocurrency history.

Today, we are witnessing the next evolution of this invention: perpetual stock contracts . While currently popular primarily on niche on-chain platforms like Hyperliquid, BitMEX will soon launch its own US stock perpetual product. We firmly believe that 24/7 perpetual stock trading is the inevitable end of finance.

Stock perpetual contracts on Hyperliquid are synthetic, cash-settled contracts:

● Quanto (dual currency) exposure: You do not hold shares or have voting rights. You trade price feeds settled in USDC.

● No dividends: Unlike holding NVDA spot, you don't receive dividends. The impact of dividends is already "priced in" into the funding rate curve.

● 24/7 trading: This is key for arbitrageurs. Nasdaq closes at 4 p.m., but this thing operates 24/7.

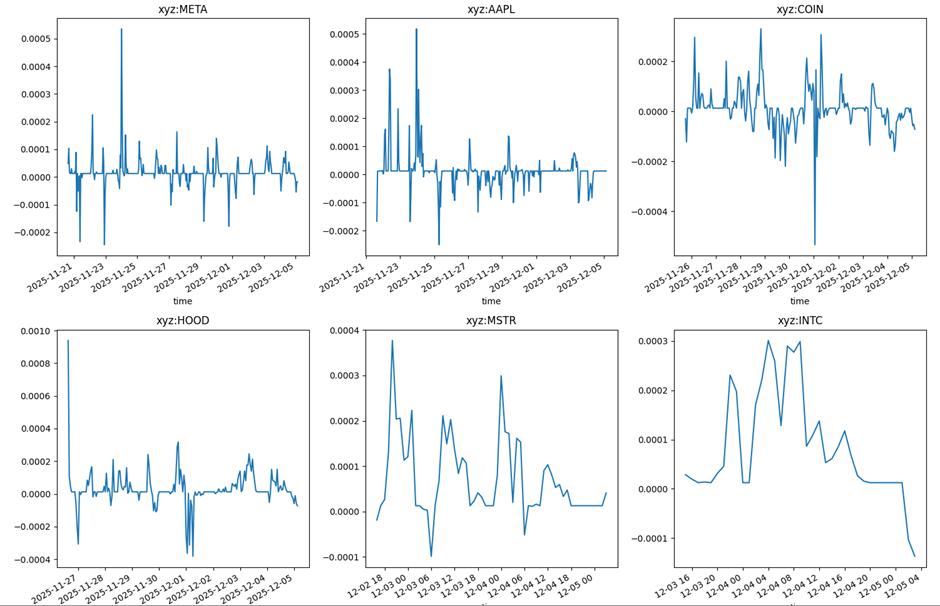

● Why arbitrage? Funding fees are settled hourly. If you hold a short position (short) over the weekend, you can earn funding fees for 48 hours while the underlying spot market is "frozen."

Opportunity: Funding Arbitrage in US Stocks

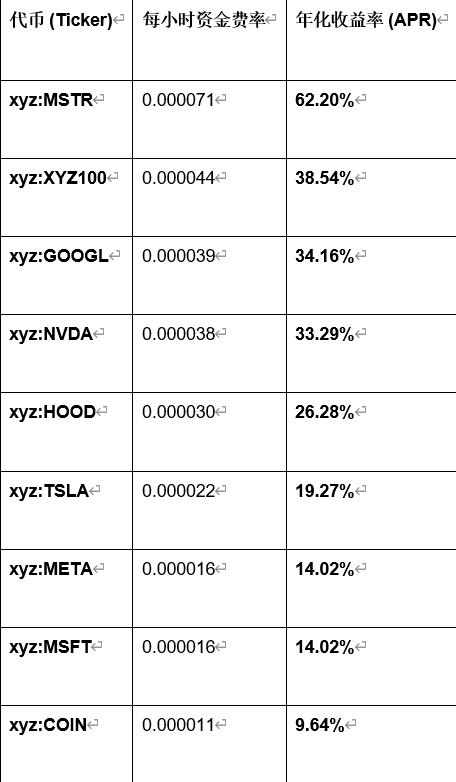

Below is a snapshot of the returns of some assets:

Specific operational strategies

● Asset Class: HIP-3 Stock Perpetual Contracts (Trade.xyz on Hyperliquid)

● Target company: NVDA (NVIDIA)

● Yield: ~30%

This strategy is essentially Delta-neutral basis harvesting . You are exploiting the pricing inefficiencies between on-chain "24/7 Degen traders" and off-chain "9-to-5 traditional traders".

Transaction Structure

- Long (off-chain): Buy spot NVDA in a brokerage account.

- Short (on-chain): Short the NVDA-USDC perpetual contract on Hyperliquid.

Your advantage (Edge): Because your notional amount is the same in both directions, your net Delta is 0. Whether NVDA rises to $500 or falls to $50 is irrelevant to you. You are simply harvesting funding rates —money that retail investors eager to leverage pay for your "tuition" every hour.

in conclusion

We invented cryptocurrency perpetual contracts at BitMEX, and it's inevitable that this superior market tool will eventually "devour" traditional assets.

The current price dislocation in US stock perpetual contracts presents a rare window of opportunity where market structure, retail investor psychology, and regulatory frictions overlap, creating excess returns (alpha). For experienced traders capable of managing the liquidation risk of highly volatile assets, shorting "Degen buys"on SHORT stock perpetual contracts is currently one of the most attractive risk-adjusted returns in the ecosystem.

BitMEX will soon launch its own US stock perpetual contracts. Please stay tuned.